DAO

Decentralized Autonomous Organizations (DAOs) are entities without central leadership that are governed by computer code on a blockchain. Usually, DAOs have a built-in treasury only accessible with the approval of DAO members. They are permissionless, meaning everyone has the chance to participate and contribute, leading to a flat hierarchy where all participants have equal rights. Usually, decisions are made by voting, with one governance token equaling one vote. In contrast to traditional forms of organization, DAOs enable broader participation and the opportunity for every member’s voice to be heard.

History of DAOs

The launch of Ethereum in 2015, with its smart contract functionality, allowed for the creation of DAOs. Smart contracts enabled autonomous and trustless systems, controlled by computer code rather than people. This led to the creation of decentralized exchanges (DEXs), fungible tokens, non-fungible tokens (NFTs) and DAOs.

The first real life application of a DAO was ‘The DAO’, launched in 2016 on Ethereum. Unfortunately, a vulnerability in its smart contract code was exploited by hackers, who withdrew 3.6 million ETH (approx. $60M at the time but more than $5bn as of writing). This incident caused disputes in the Ethereum community on how to handle the situation and eventually led to a hard fork into Ethereum and Ethereum Classic. The former implemented a change to undo the hack but the latter, Classic Ethereum, kept the "original" chain without changes, its community insisting that code is law, even if someone uses the code in a way not intended by its developers.

How DAOs work

In decentralized autonomous organizations, decisions are made collectively by members. The rules of the underlying smart contract define how the organization operates, including who can view, participate and vote on proposals – to prevent spamming, limits can be set around how to submit these proposals.

DAOs are fully autonomous and transparent, including the ability for everyone to audit their built-in treasuries. A computer program manages the process and enforces the implemented rules, but it is the community that decides on the instructions. New code can only be implemented with community approval, removing the need for trust between parties.

The flat hierarchy and transparency of DAOs offer a potential mitigation of the common principal/agent problem. In traditional organizations, an agent (e.g. management) may act in their own interest, rather than that of the principal (e.g. shareholders). Examples of the principal/agent problem include agency costs in corporations, and the unequal distribution of benefits in government. By removing intermediaries, improving transparency, and allowing all members to participate in decision-making, DAOs aim to align the interests of the agent and principal, thereby reducing the scale and likelihood of principal/agent problems.

Applications and examples of DAOs

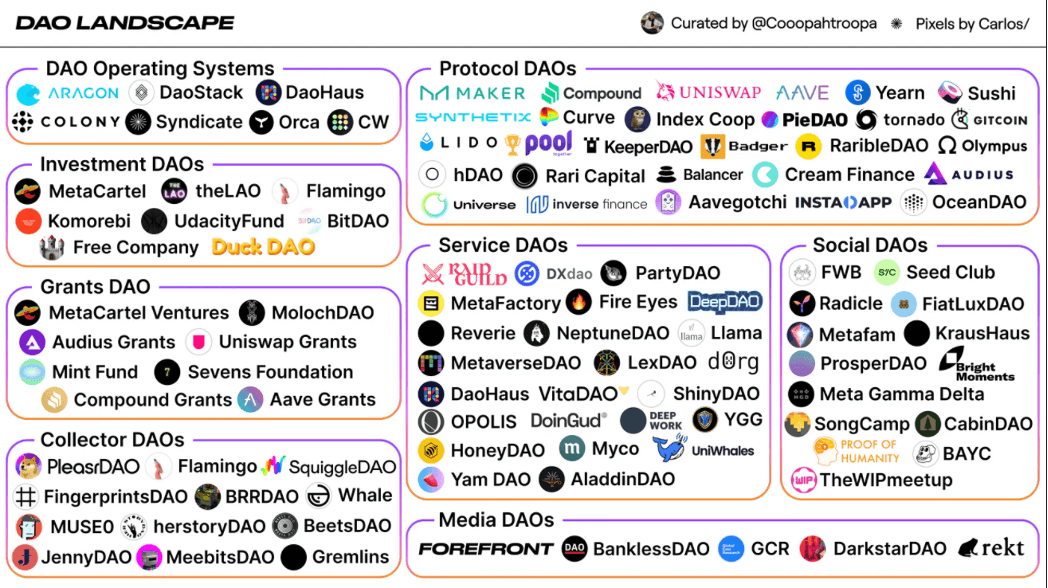

DAOs have numerous applications, ranging from crypto projects to grant funding, investments, and collective ownership.

- Crypto projects: Many cryptocurrency projects are considered DAOs as they are often managed by decentralized governance, or aim to become a DAO over time. This means that token holders can vote on the direction of the project. Examples include MakerDAO and Uniswap.

- Grant funding: DAOs can be used to automatically award grants or development funds based on pre-defined criteria. Examples include MolochDAO and Aave Grants.

- Investments: Commercial DAOs can be used to distribute and transfer shares and other assets between participants. These are often established based on a fork of MolochDAO. Examples include MetaCartel Ventures and BitDAO.

- Collective ownership: DAOs can also be used to collectively buy and own items such as NFTs or real-world assets and art. Examples include Flamingo DAO, SquiggleDAO, and BeetsDAO.

Figure 1: DAO Landscape. Source: Coopahtroopa

Flamingo DAO

To examine the evolution and governance of a DAO, let’s consider Flamingo DAO. Flamingo is a member-managed group organized as a Delaware LLC that relies on smart contracts to decide on NFT-investments and governance. It was launched in October 2020 and to participate members had to pay ETH 60 (approx. $23,000 at the time). Total membership is limited to 100 members and no member is able to hold more than 9% of outstanding tokens. Upon entry, smart contracts ensure the member has to pass KYC and accredited-investor requirements.

All members can put forward proposals to other members to acquire certain NFTs, which will subsequently be voted on via an on-chain vote. Following each voting period, every member gets the opportunity to ‘rage quit’ – this option of last resort gives any undeployed capital back to the member.

By early 2022, the entry-fee to the DAO for prospective members had increased to ETH 3,000 (approx. $8m at the time), a 350-fold increase, mainly due to the DAOs successful NFT-portfolio that featured 1000s of NFTS, including 215 CryptoPunks, 22 Bored Apes, 246 Chromie Squiggles, 5 Autoglyphs, and other ‘blue-chip’ NFTs. While the portfolio’s value has fallen over the past year, in line with the market, the investment performance remains impressive.

Difficulties and uncertainties

DAOs are not without problems. One difficulty is their efficiency – while decentralized governance and broad participation improve transparency and (potentially) efficiency for large, global changes to the DAO or the governed protocol, it can lead to inefficiencies and slow decisions when applied to every small change and decision. Another difficulty is the risk of centralization, which largely depends on the initial rules and/or token distribution of the DAO. Furthermore, the vote weight is usually determined by the number of tokens, not users, which can overweight large token holders (‘whales’). There are also technical and smart contract risks that need to be taken into consideration. Ultimately, and possibly most crucially, there is legal uncertainty surrounding DAOs, as regulations in most countries are generally unclear. To make matters even more complex, DAOs are not limited geographically, and they can easily spread across multiple jurisdictions, leading to additional legal issues and uncertainty.

Conclusion

DAOs are a promising tool for creating a more equitable and decentralized future with web3. They are entities without central leadership that are enabled by blockchain technology and controlled by computer code, providing improved transparency and member involvement by removing hurdles for participation. DAOs have a flat hierarchy where all participants have equal rights and decisions are taken through voting. They offer a broad range of applications in all kinds of organization, including crypto projects, grant funding, investments, and collective ownership, as well as other use cases yet to be explored. Despite difficulties and uncertainties, such as inefficiency, potential centralization, legal uncertainty, and technical and smart contract risks, DAOs are a field worth watching during the continued development of decentralization and web3.